Tax Management

Tax requirements for marketplaces can be overwhelming, as they vary from country to country.

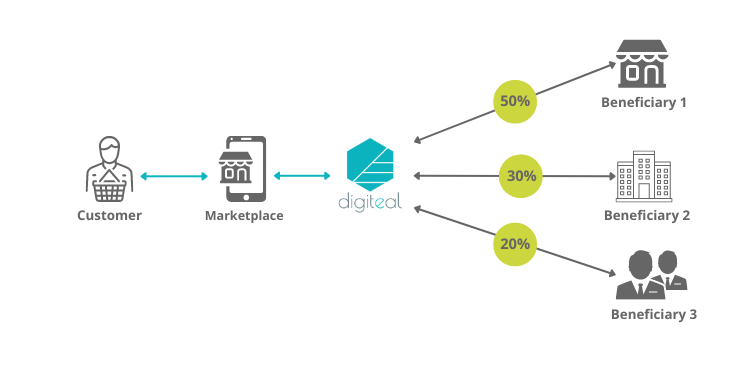

However, marketplaces are now responsible for collecting VAT and sales taxes in many countries. Tax compliance is a fundamental requirement for global sales.

Fee-based services are then available for calculating taxes in different countries (managing VAT/GST), managing tax accounting, creating monthly tax reports, anticipating tax audits, etc.